Catalog excerpts

Interim Report 2019 2nd quarter Half-Year Report

Open the catalog to page 1

Interim Report | 2nd quarter 2019 | Half-Year Report aap * Sales for the last four quarters ** XETRA closing prices of the day; data source: Bloomberg; remark: aaps share price data for parts of the first half of 2019 and the entire first half of 2018 were adjusted retrospectively by Bloomberg by a subscription right deduction from the recent capital increase with subscription rights. The majority of the share price data listed below refer at least in parts to these adjusted values. Accordingly, the share price data for the first half of 2018 deviate from the information provided in the...

Open the catalog to page 2

Interim Report | 2nd quarter 2019 | Half-Year Report Table of Contents Selected Figures Foreword by the Management Board Interim Group Management Report • Business and General Conditions • . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 • Economic Report • Earnings Position Asset Position Financial Position • Risk and Opportunity Report • . . . . . . . . . . . . . . . . ....

Open the catalog to page 3

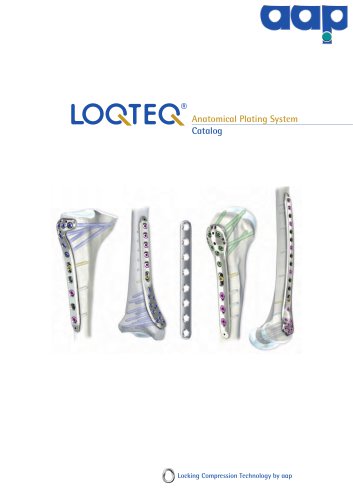

Interim Report | 2nd quarter 2019 | Half-Year Report Foreword by the Management Board Dear Sir or Madam, system at the beginning of 2020 in the US and in other markets Dear Shareholders, that accept FDA approvals. We are also working on the docu- Dear Employees and Business Partners, ments for the corresponding conformity assessment procedure for the CE label in order to be able to market the system in Eu- We achieved our financial objectives in the second quarter, rope as well. In addition, there was a focus on implants in sterile however with sales and EBITDA at the lower end of the guid-...

Open the catalog to page 4

Interim Report | 2nd quarter 2019 | Half-Year Report Furthermore, we implemented a package of measures to and we have already implemented the first measures. Initially, strengthen our financial base in the second quarter. We suc- we opted for a change in the stock exchange listing from Prime cessfully completed a capital increase with subscription rights Standard to General Standard on the regulated market of the with gross issuance proceeds of around EUR 3.5 million and Frankfurt Stock Exchange. This eliminates the need for various two further external financings. We accrued a total of...

Open the catalog to page 5

Interim Report | 2nd quarter 2019 | Half-Year Report aap General Information about aap's Share * Data source: Bloomberg. Figures relate to XETRA closing prices of the day. ** As of 30/06/2019 the number of bearer shares amounted to 32,067,377 and as of 30/06/2018 to 28,674,410. an expansive monetary policy from the US Federal Reserve and the European Central Bank with the prospects for potential interest rate cuts. At the same time, the trade conflict between the US and China, as well as fears about a slowdown in global economic growth, repeatedly caused temporary uncertainties on the stock...

Open the catalog to page 6

Interim Report | 2nd quarter 2019 | Half-Year Report Indices Share Price Comparison H1 | 2019 40% DAXsubsector Medical Technology Analysts’ Recommendations All research reports by the analysis firms are available at Research Company Warburg Research GmbH Hauck & Aufhäuser Privatbankiers AG Ulrich Huwald Aliaksandr Halitsa Target Price aap Implantate AG 5 Lorenzweg 5 • 12099 Berlin

Open the catalog to page 7

Interim Report | 2nd quarter 2019 | Half-Year Report Investor Relations Shareholder Structure The objective of investor relations work at aap is to achieve a The first half of 2019 saw in particular as part of the success- fair valuation of the share through the capital market. In the fully implemented capital increase with subscription rights first half of 2019, this was again based on a continuous dialog changes in aap’s shareholder structure, which did not signifi- with all market participants, as well as the transparent provi- cantly affect the overall picture. aap’s shareholders structure...

Open the catalog to page 8

Interim Report | 2nd quarter 2019 | Half-Year Report Shareholdings Executive Bodies The table below shows the direct and indirect shareholdings of all members of the Company's Supervisory Board and Management Board as of June 30, 2019: Capital Increase In the second quarter of 2019 aap successfully implemented a capital increase with subscription rights as part of a package of measures to strengthen the financial base. Within the transaction the Company's shareholders were offered up to 4,784,485 new aap shares for subscription at a subscription price of EUR 1.04 per new share in an...

Open the catalog to page 9

Interim Report | 2nd quarter 2019 | Half-Year Report aap Organizational and Legal Structure In the consolidated financial statements, aap Implantate AG and all of its companies have been consolidated using the full consolidation method, in which the parent company aap Implantate AG directly or indirectly holds the majority of voting rights through consolidated subsidiaries. Subsidiaries aap Implants Inc. aap Implants Inc. is the distribution company of aap Implantate AG for the North American market. The company is based in Dover, Delaware, USA. All orders are logistically handled via a...

Open the catalog to page 10

Interim Report | 2nd quarter 2019 | Half-Year Report will further increase the attractiveness for full-service clinics plied for. In addition, the application for approval of the human and purchasing groups. In addition, there was a focus on im- clinical study in the US has been submitted at the FDA at the plants in sterile packaging and adapting processes and docu- beginning of August. From today's perspective, it is not possible ments to the new regulatory requirements of the new EU Med- to predict when approval for the study will be granted in the ical Devices Regulation (MDR) in the...

Open the catalog to page 11

Interim Report | 2nd quarter 2019 | Half-Year Report Economic Report The cost of materials fell from EUR 0.6 million in the second quarter of 2018 to EUR 0.4 million in the reporting period and in Earnings position the first half of the year were EUR 0.8 million, thus below the Sales and margin development as well as total operating level of the previous year (H1/2018: EUR 1.1 million). The cost of materials ratio (with regard to sales revenues and changes in in- Sales in the second quarter of 2019 were EUR 2.5 million ventories) decreased in the second quarter of 2019 to 17% (Q2/2018: EUR...

Open the catalog to page 12